maine excise tax form

Electronic Request Form to request individual income tax forms. Maine Amphibian and Reptile Atlasing Project MARAP Site Card.

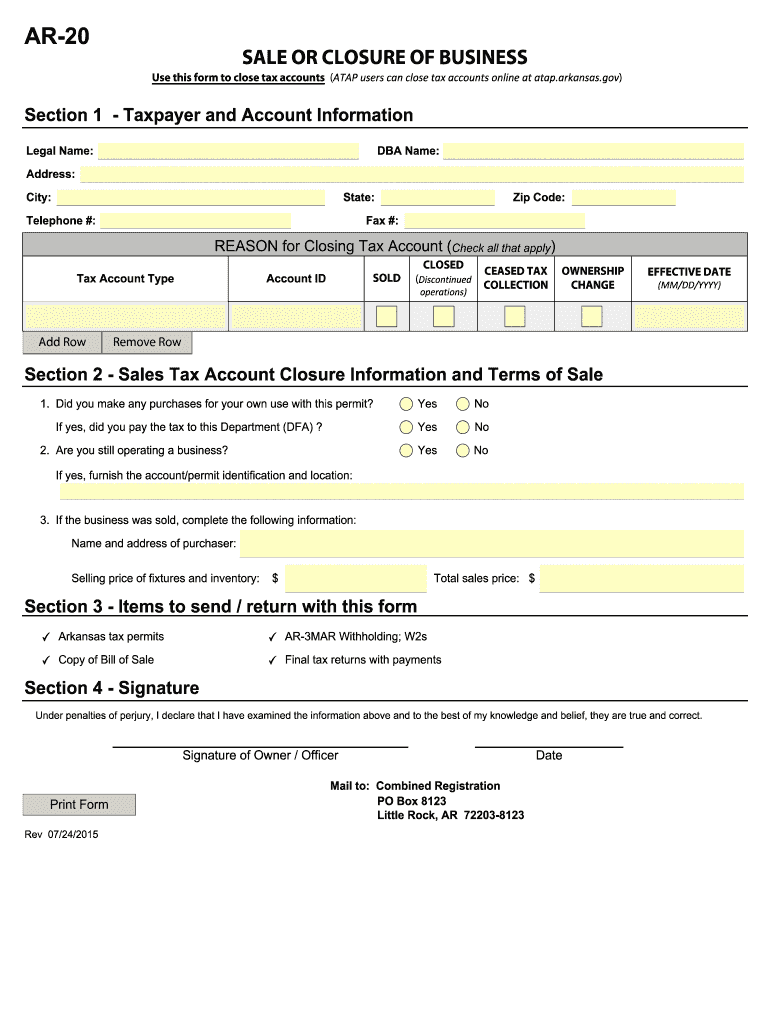

Ar Ar 20 2015 2022 Fill Out Tax Template Online Us Legal Forms

This one-day basic course is designed to focus on the procedures of excise tax.

. Maine is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. This enables residents to get their vehicle registrations and plates at the Town Hall without going to the BMV. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land.

Pursuant to MRS Title 36 Ch. 2022 Watercraft Excise Tax Payment Form. 2018 -- 650 per 1000 of value.

This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves. Watercraft Excise Tax Payment Form. Tax payments for these tax types can be made now via the Maine Tax Portal MTP at.

Payments are electronically withdrawn right from your bank account. Ad The Leading Online Publisher of Maine-specific Legal Documents. YEAR 4 0100 mill rate.

Active Duty Stationed In Maine Excise Tax Exemption MV-7 Antique Auto Antique Motorcycle Horseless Carriage Custom Vehicle and Street Rod Affidavit MV-65 Authorization for Registration MV-39 Disability PlatesPlacard Application PS-18 Duplicate Registration MV-11 Emergency Medical Services Plate Application MVR-17. The Form can be found at Bureau of Motor Vehicle Web site or the link below. 2020 -- 1350 per 1000 of value.

There are several ways to find the MSRP. Get Access to the Largest Online Library of Legal Forms for Any State. Boat Launch Season Pass - Piscataqua River Boat Basin.

Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813. 2022 -- 2400 per 1000 of value. Because Maine is a member of this agreement buyers can use the Multistate Tax Commission MTC Uniform Sales Tax Certificate when making qualifying sales-tax-exempt purchases from.

Calculation will be based on. If you are renewing an existing registration the MSRP is called the Base Price on your current registration form upper right-hand corner of the registration document. YEAR 3 0135 mill rate.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Wildlife Rehabilitator Annual Report Form 2019. Total Excise Tax Due multiply line 7 by 035 thirty-five cents 8.

How is the excise tax calculated. YEAR 5 0065 mill rate. When importing malt liquor into Maine.

For example the owner of a three year old motor vehicle with an MSRP of. Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. The excise tax due will be 61080.

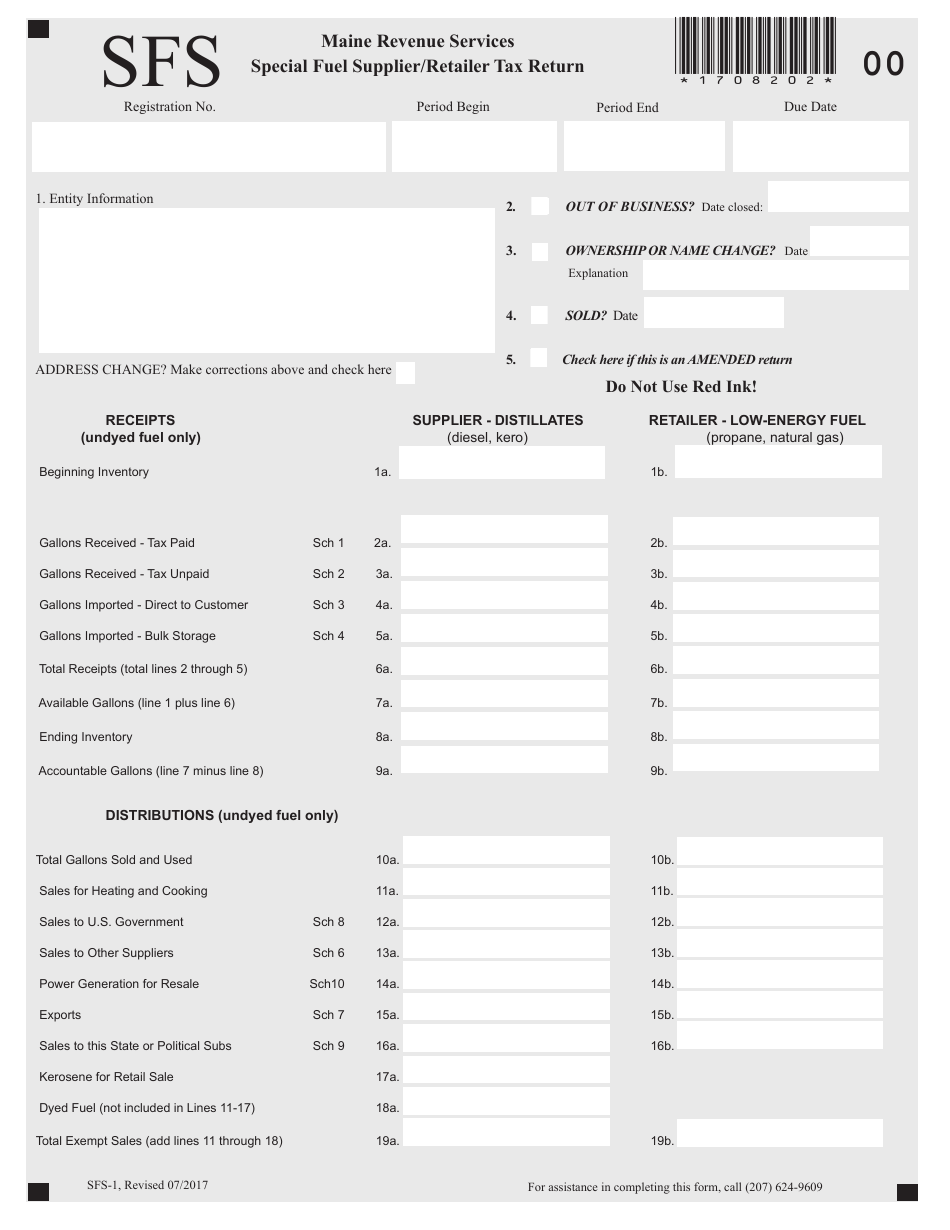

Under Used Cars select the make and. OWNERSHIP OR NAME CHANGE. Marijuana Excise Tax Return.

2019 -- 1000 per 1000 of value. Tracie York Tax Collector Town of Lincoln. Navigate to MSN Autos.

An excise tax is imposed on the privilege of manufacturing and selling wine in the State. The following vehicles must be registered and excised at. 2721 - 2726.

Maine Municipal Association 60 Community Drive Augusta Maine Time. Period Begin Period End Due Date. The rates drop back on January 1st of each year.

You may also be able to find the MSRP online at sites such as MSN Autos. YEAR 2 0175 mill rate. Excise Tax Reimbursement Policy Procedures The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs.

Boat Registration Form Use Tax Certificate required for new registrations Boat Dealer Registration. I have entered this info in Federal Taxes under deductions and credits. Except as provided in subsection 2-A the in-state manufacturer or importing wholesale licensee shall pay an excise tax of 60 per gallon on all wine other than sparkling wine fortified wine or hard cider manufactured in or imported into the State 124 per gallon on all sparkling wine.

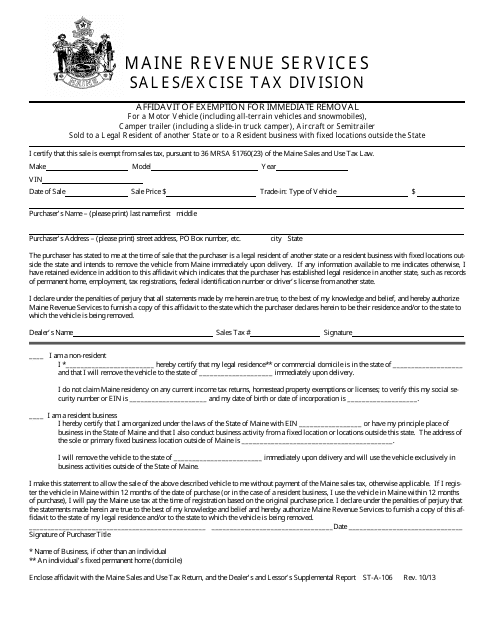

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or. The Town of Freeport is a full service agent for the State of Maine for the purpose of issuing New Registrations and transfers for vehicles. 112 15041 excise tax shall be paid within 10 days of the first operation of the watercraft upon the waters or prior to July 1st whichever comes first.

See also additional excise tax below Maine manufacturer When selling low-alcohol spirits products to a. By signing this tax excise tax report the licenseeunderstands that false statements made on this are punishable by form law. The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation.

When offering samples at a taste-testing festival. Member - 55 Non-member - 85 Instructor. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

To apply for the exemption the resident must provide documentation by filling out The Active Duty Stationed in Maine Excise Tax Exemption Form. Please contact our office 207-439-1817 with any questions or for assistance with the calculation of the excise tax due. Real Estate Withholding REW Worksheets for Tax Credits.

Home of Record legal address claimed for tax purposes. 2022 Watercraft Excise Tax Payment Form. YEAR 1 0240 mill rate.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Commercial Forestry Excise Tax. Check here and make the appropriate changes to the.

Boat Excise Tax Exemption Form. 2022 Watercraft Excise Tax Payment Eliot Maine. 2 Low-alcohol spirits products excise tax 124gallon spirits products to Maine retailers.

Check here if this is an AMENDED return. Registering Vehicles and Excise Tax. Emphasis will be placed on how to calculate excise tax and.

Maine taxpayers now have the option to pay various tax payments online quickly and easily. Welcome to Maine Revenue Services EZ Pay. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

YEAR 6 0040 mill rate. HttpwwwmainegovsosbmvformsMV-720Active20Duty20Excise20Exemption20Formpdf To read the State law. Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due.

2017 Older -- 400 per 1000 of value. 2021 -- 1750 per 1000 of value.

Form 1040 Ez T Request For Refund Of Federal Telephone Excise Tax

Kansas Ranks In Top Half Of States With Most Burdensome Taxes

Maine Use Tax Form Fill Online Printable Fillable Blank Pdffiller

105 Form 2290 Tax Computation Table Page 5 Free To Edit Download Print Cocodoc

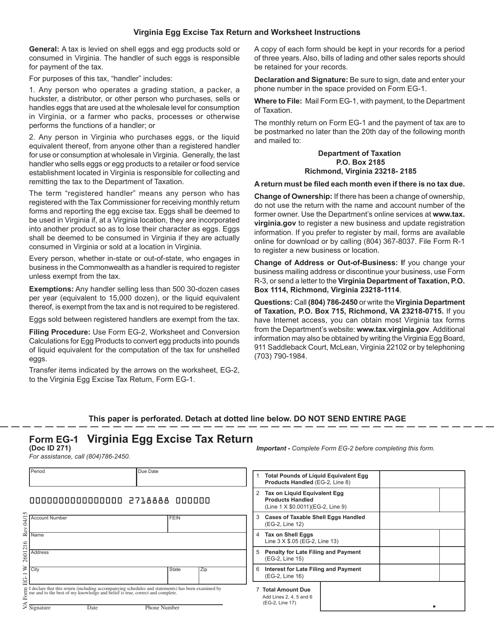

Form Eg 1 Download Fillable Pdf Or Fill Online Virginia Egg Excise Tax Return Virginia Templateroller

Arizona Tax Forms 2021 Printable State Az Form 140 And Az Form 140 Instructions

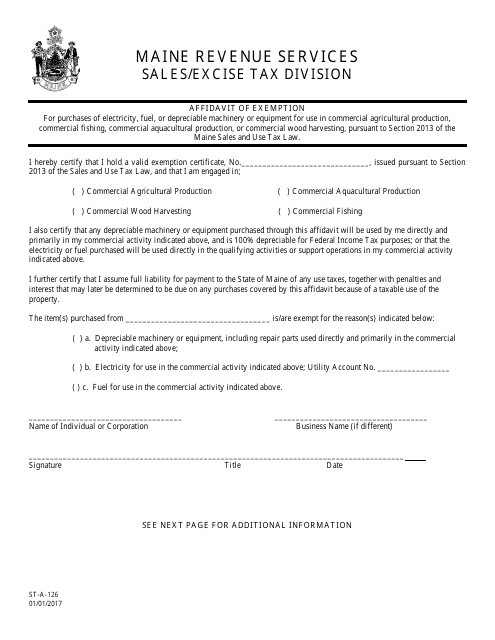

Form St A 126 Download Printable Pdf Or Fill Online Affidavit Of Exemption Maine Templateroller

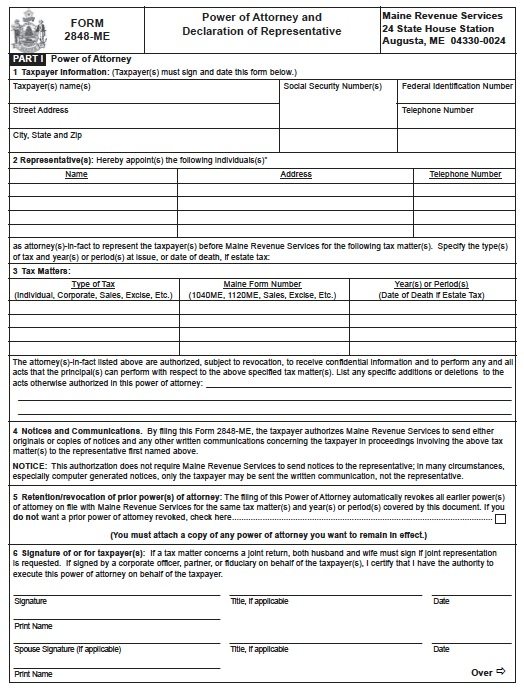

Free Tax Power Of Attorney Maine Form Adobe Pdf

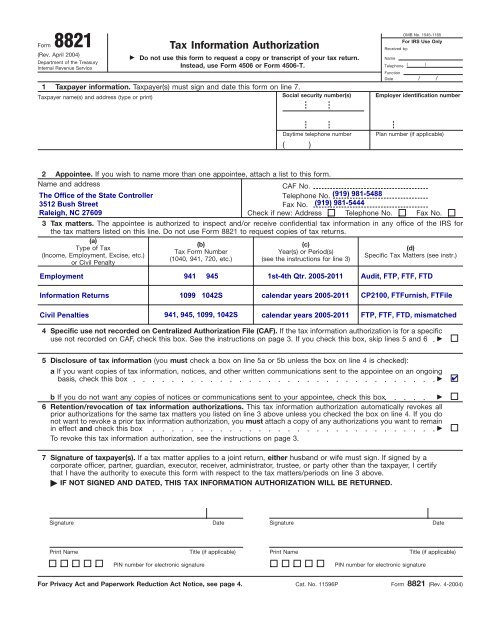

Irs Form 8821 Tax Information Authorization North Carolina Office

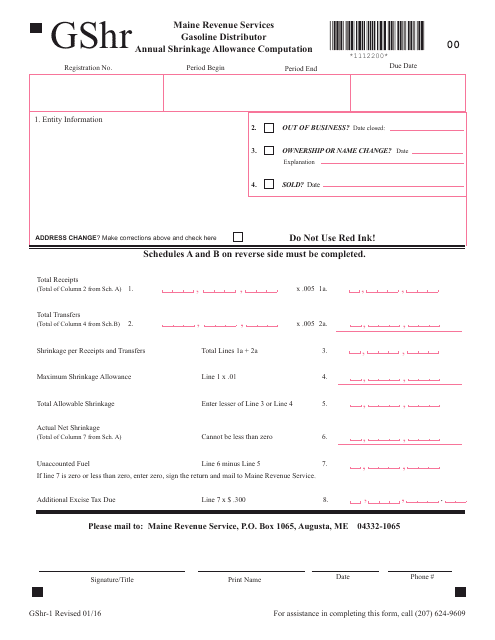

Form Gshr 1 Download Fillable Pdf Or Fill Online Gasoline Distributor Annual Shrinkage Allowance Computation Maine Templateroller

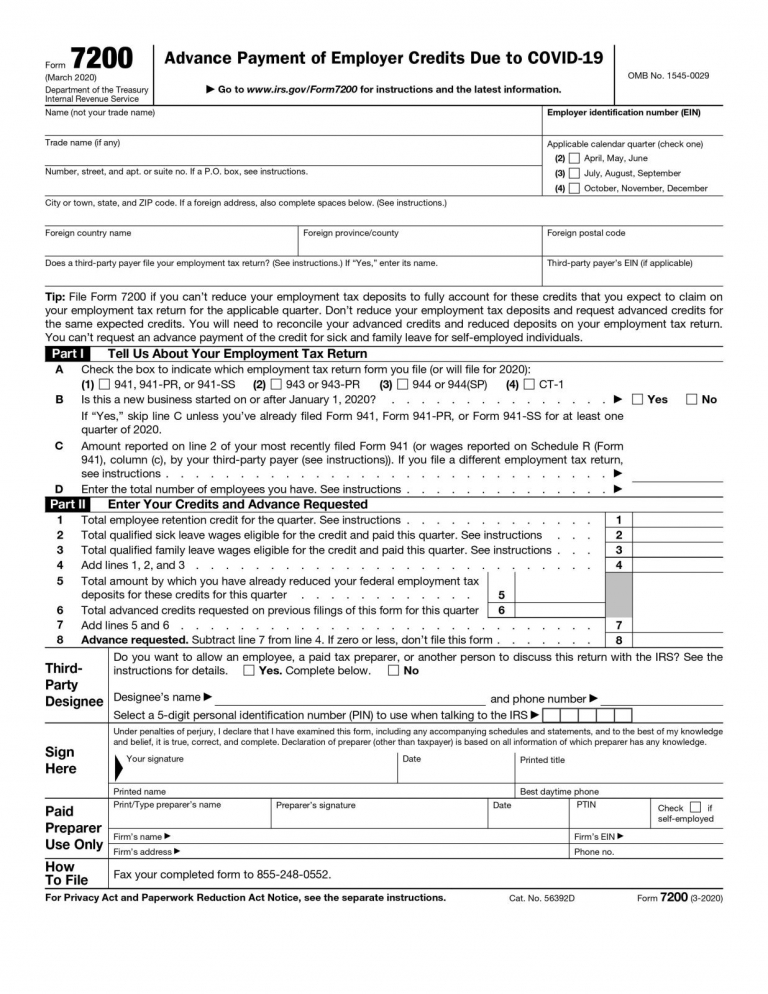

Irs Issues Form 7200 Albin Randall And Bennett

Form Sfs 1 Download Fillable Pdf Or Fill Online Special Fuel Supplier Retailer Tax Return Maine Templateroller

Irs Releases Drafts Of 2021 Form 1040 And Schedules Don T Mess With Taxes

Irs Form 8924 Download Fillable Pdf Or Fill Online Excise Tax On Certain Transfers Of Qualifying Geothermal Or Mineral Interests Templateroller

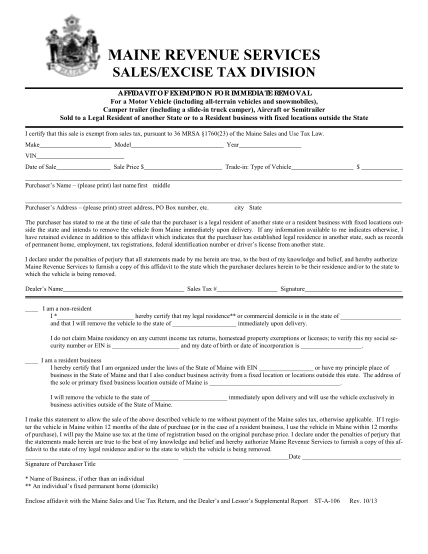

Form St A 106 Download Printable Pdf Or Fill Online Affidavit Of Exemption For Immediate Removal Maine Templateroller

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return